We are your go-to source for all your borrowing needs, whether it’s a personal loan, car loan, mortgage, or anything in between. Our mission is to make lending easy and accessible to everyone, regardless of their financial situation.

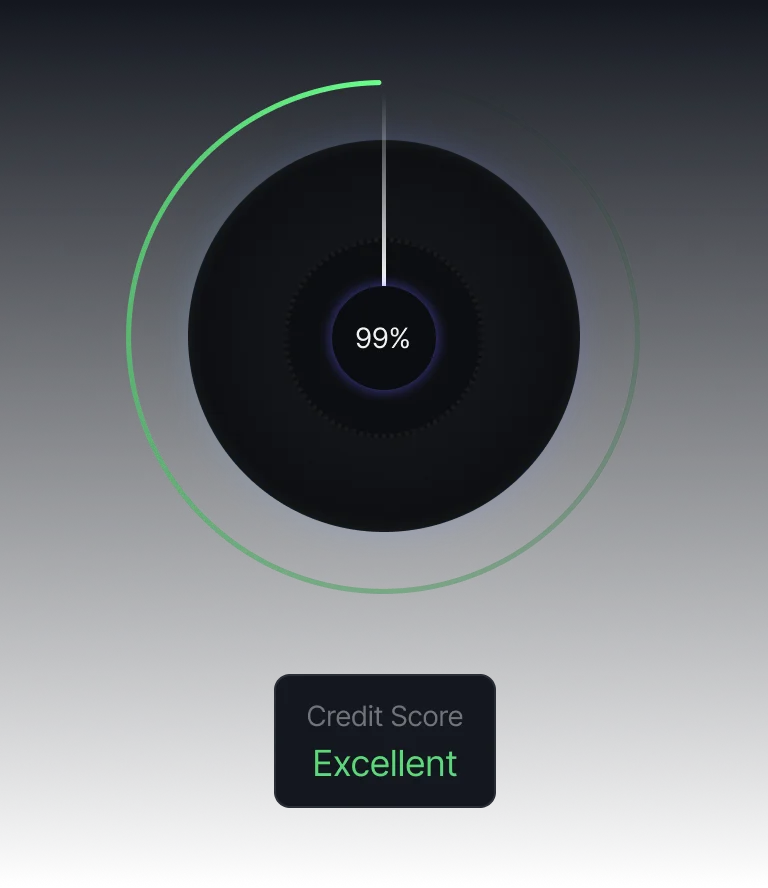

Credit scores are usually calculated using information from your credit report, which includes your payment history, the amount of debt you owe, the length of your credit history, and the type of credit accounts you have

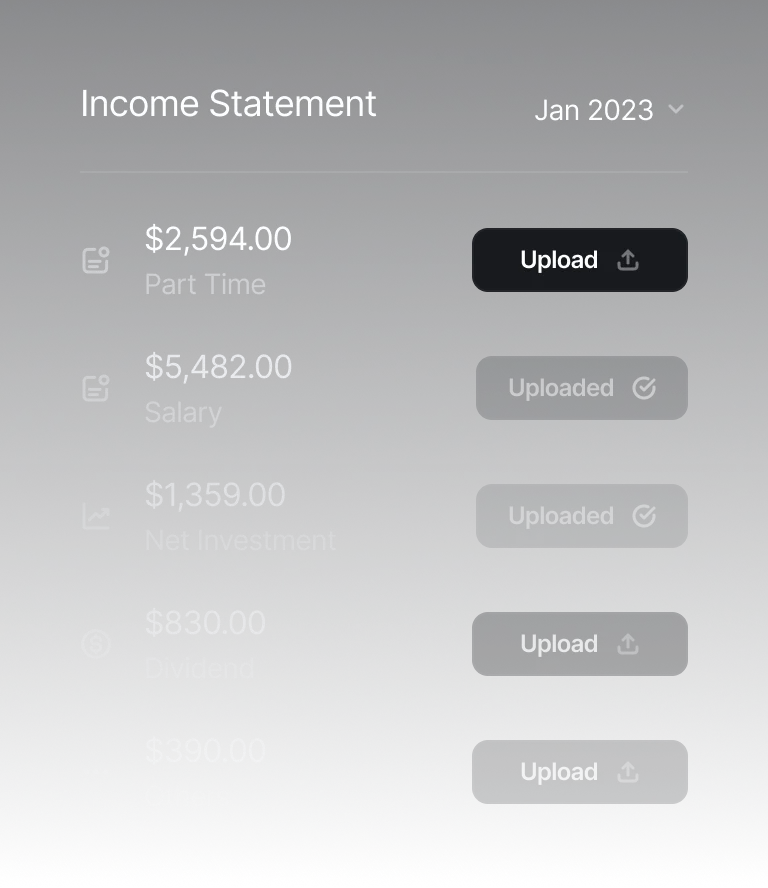

When evaluating a borrower’s ability to repay a loan, particularly for larger loans like mortgages, lenders look at their income. A borrower’s creditworthiness is demonstrated by stable and sufficient income, which also lowers the danger of default.

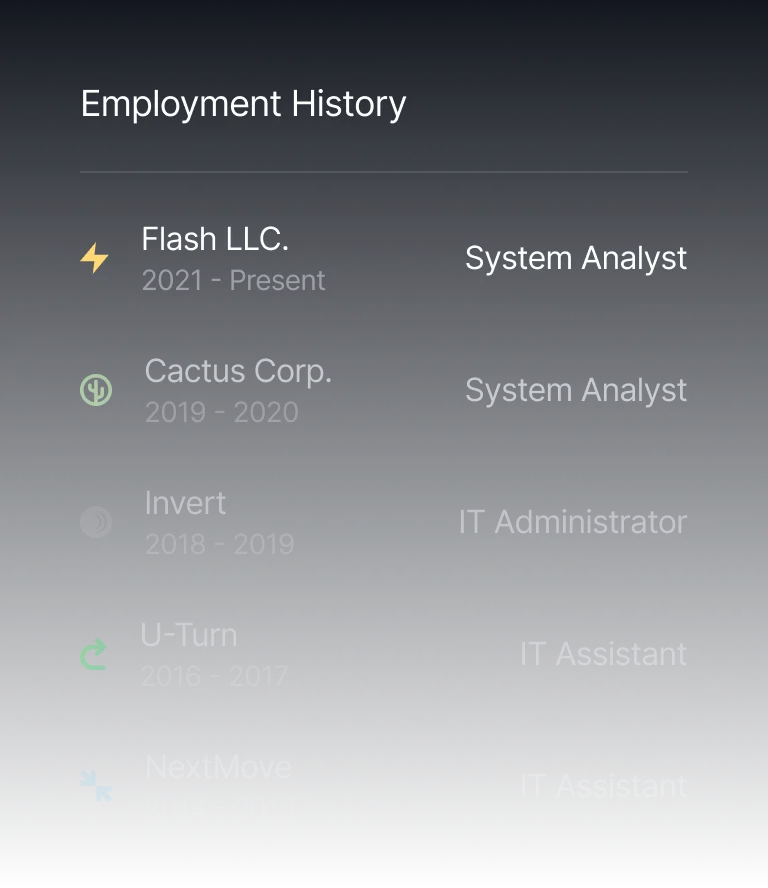

Lenders utilize these details to evaluate the stability of income, job security, and overall creditworthiness. A thorough employment history, encompassing employer names, start and end dates, and employment status, aids lenders in assessing a borrower’s financial capability.